- View all help sheets

Help by technology

- Adobe Creative Cloud

- Anthology Portfolio

- Bookings with Me

- Campus Cable TV

- Canvas

- Cat Card

- Classroom Technology

- File Storage

- Firefly

- Follett Discover

- Get Connected (Internet)

- Kaltura (Video Management)

- M365 (Office 365)

- Make Me Admin

- Multifactor Authentication (Duo)

- Office Technology

- OneDrive

- Online Student Resources

- Outlook Email

- PaperCut (Printing)

- Rave (Campus Text Alerts)

- SANS Security Training

- TAO

- Teams

- Turnitin

- Valt (Classroom Video Recording)

- Wildcat360

- WildcatsOnline

- WSC Password

- Zoom (Video Conferencing)

Contact Service Center

Can't find what you're looking for in our help sheets?

Click: https://www.wsc.edu/service-center

Call: (402) 375-7107

Visit: U.S. Conn Library 1st Floor

Student Account Payments and Outstanding Balances on WildcatsOnline

1. Go to the WSC home page, click on myWSC at the top, and log in.

2. Select WildcatsOnline from the Top Applications section.

3. Select the Student Account tab.

Pay Bill Online

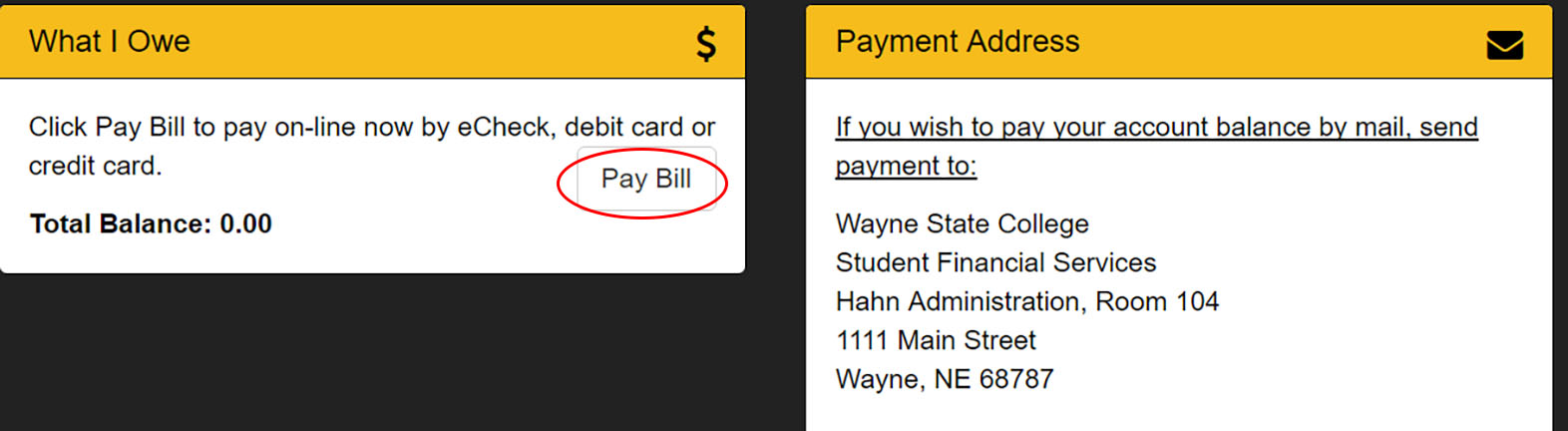

Click on the Pay Bill button to pay any outstanding account balance (Under the What I Owe at the top of the page).

Account Activity by Term

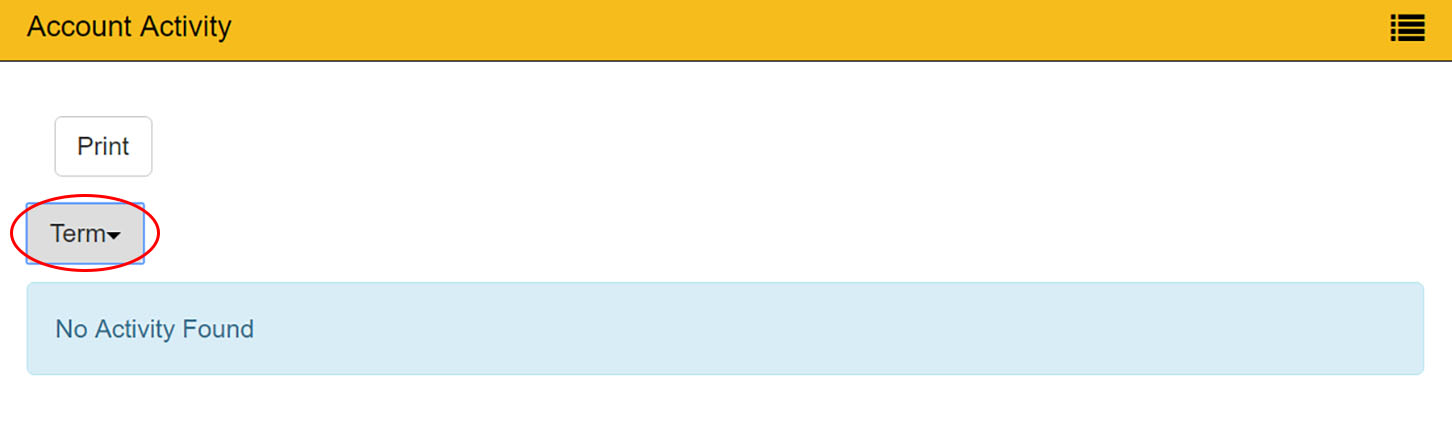

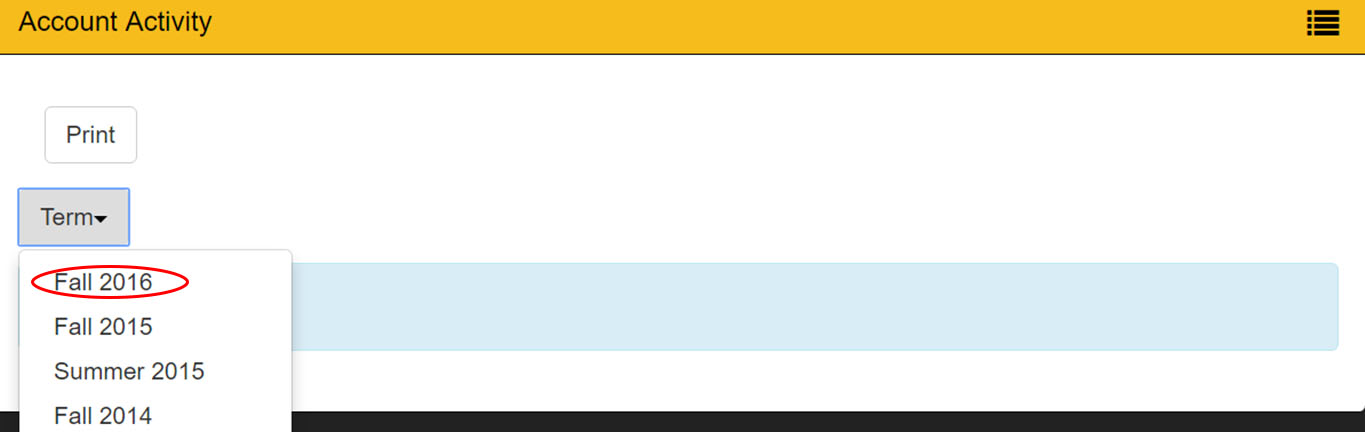

1. In your WildcatsOnline account, go to the Student Accounts section and scroll down to the Account Activity by Term section.

2. Click Term, and select the term you want to see the billing for.

Note: You can print this statement. This shows all credits and debits made to your account in real-time and is the most up-to-date location to view your student account.

Note: Click on a specific description to view more detailed information including when it was billed and when payment is due.

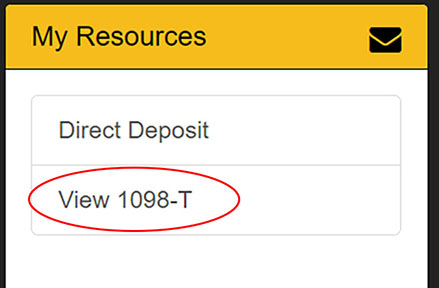

View your 1098-T tax form

The 1098-T form can be viewed or printed at https://www.wsc.edu/directory_record/18115/access_1098-t_on_wildcatsonline . In 2017, Wayne State College changed the 1098-T reporting method.

Please be advised that the 1098-T runs from the calendar year of January 1st through December 31st. The tax rules regarding eligibility for, calculation of, and limitations on the tuition and fee deduction and education credits can be complex. For this reason, you may want to consult your tax advisor to determine whether you are qualified to claim the education expense tax credits and deduction.

View Balance at Other Institutions

Review any outstanding account balance(s) with other institutions (Under Balances at Other Institutions on the left hand side of the page).

Last Updated: 12/13/2021